Are you on track to retire as a millionaire? Did you know you don’t actually have to save $1 million of your own dollars to end up with $1 million in retirement?

Magic happens when you start saving for retirement early and contribute as much as you can as often as possible.

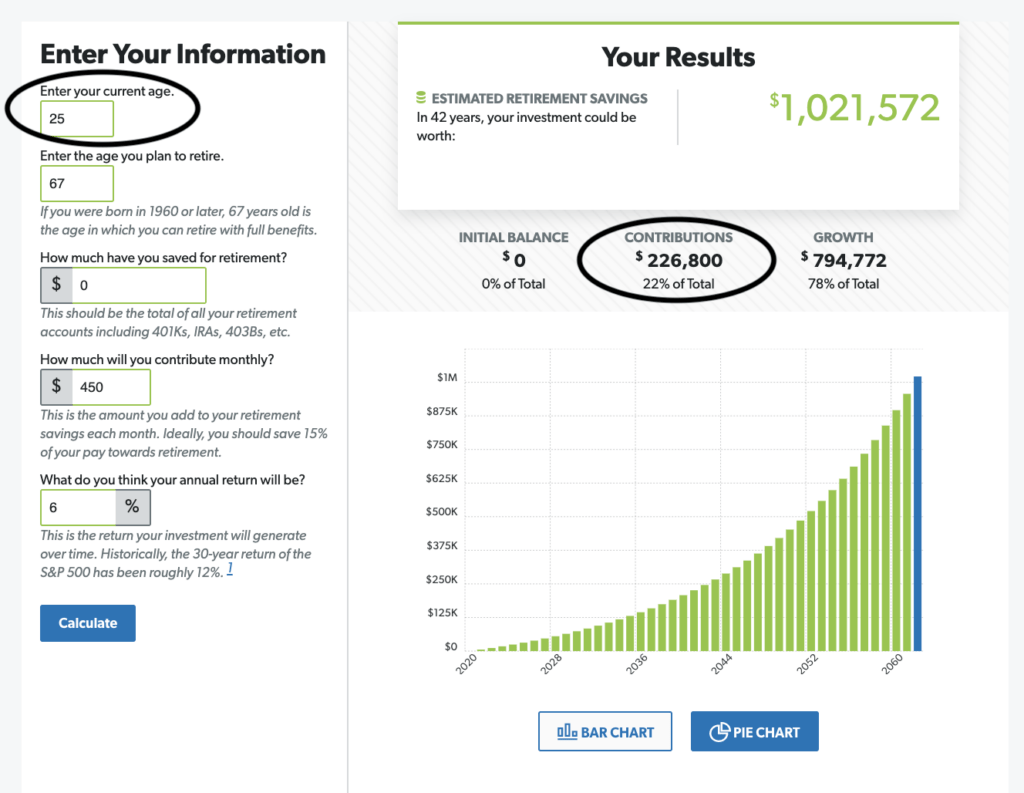

For example, if you start saving $450 a month for retirement at 25 years old and keep contributing throughout your life, you’ll retire a millionaire.

The best part is, you don’t actually have to save $1 million to retire with $1 million. You only have to save around $226,800 of your own money.

That’s because $794,722 comes from the growth of your investments inside your retirement account.

Compound interest is amazing, but you can only take advantage of its magical properties if you regularly contribute to your retirement account.

What should you do if you know you should contribute more to your retirement, but you can’t seem to find room in your budget?

Chat with a Bee Financial Coach!

A Bee Financial Coach can help you take stock of your situation. They’ll help you calculate your future retirement nest egg (using an online calculator like this) and find creative ways to make room in your budget – so you can contribute more to your retirement account.

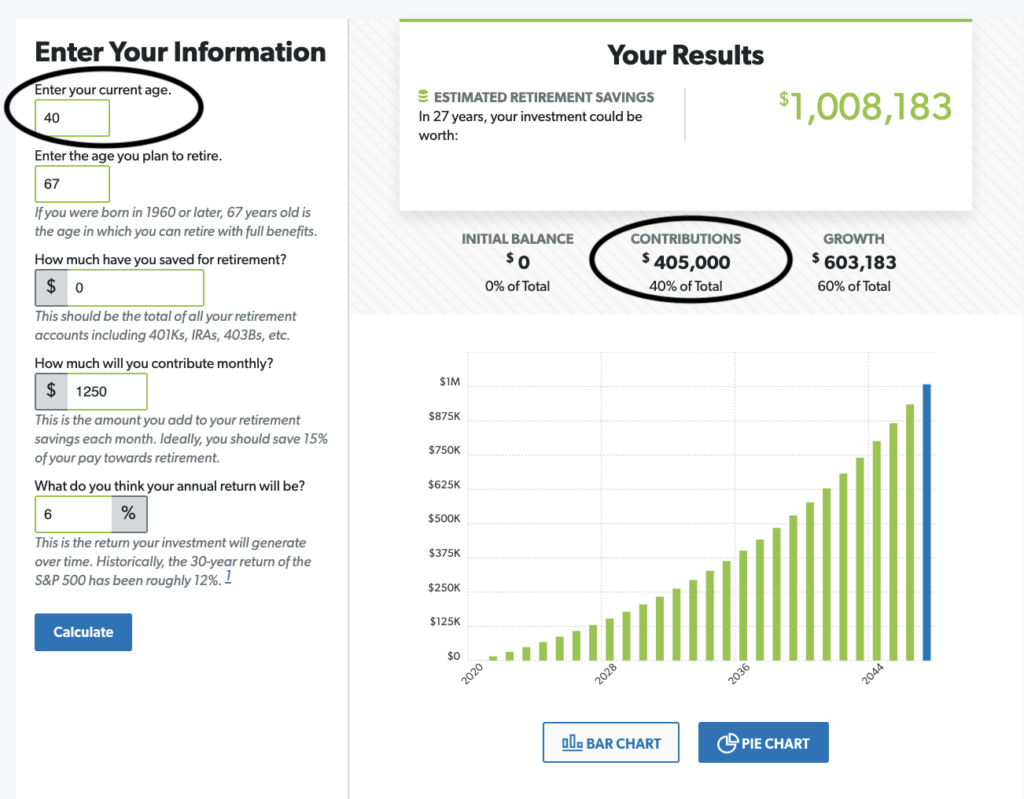

It’s never too late to course-correct. If you feel like you missed your chance to start contributing to your retirement account at 25 (most people do!) you can still harness the power of compound interest.

For example, if you start saving $1250 a month for retirement at 40 years old and keep contributing throughout your life, you’ll still retire as a millionaire.

Again, you don’t actually have to save $1 million to retire with $1 million. You’ll only have to save around $405,000 of your own money. $603,183 will come from the growth of your investments inside your retirement account.

A Bee Financial Coach can walk you through all of this stuff, so definitely schedule a session.

Here’s to you retiring as a millionaire!